Stock scanners (https://tradeideaspromocode.net/) have brought a huge revolution in the stock trading niche. Previously, traders would take a while before choosing the right stocks and now they can do it effortlessly with stock scanners. There are so many trading opportunities out there with there being so many stocks to watch and charts to view. The stock scanning technology will do all the heavy lifting thus saving time, energy and sanity.

Stock scanners (https://tradeideaspromocode.net/) have brought a huge revolution in the stock trading niche. Previously, traders would take a while before choosing the right stocks and now they can do it effortlessly with stock scanners. There are so many trading opportunities out there with there being so many stocks to watch and charts to view. The stock scanning technology will do all the heavy lifting thus saving time, energy and sanity.

What Is A Stock Scanner?

It is software that can look through numerous stocks instantly helping you identify any criteria you need. For instance, you can check the stocks with a high-trading volume compared to the average ones. Therefore, every stock you come across will meet such criteria. Thanks to the scanners, you can focus on the top trading opportunities, rather than going through everything.

Are Stock Scanners And Screeners The Same Thing?

Although these two terms are used interchangeably, they are technically different. The differences boil down to the scanning time frames. Stock screeners were developed when this technology was relatively new. They are websites were stock traders can log in and scan for the basic criteria for any interesting stock. Now, they are considered low-tech and mostly used for long-term trading.

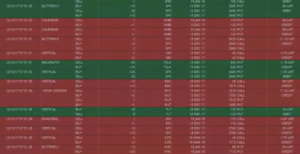

Stock scanners, on the hand, came out with the evolving nature of the internet and technology. It is powerful software you can install on your computer. The software will be connected to a data feed allowing it to scan stocks and find the best trading opportunities each second.

What Are The Best Stock Scanners In The Market?

Currently, the market is flooded with different types of stock scanners. That’s why it’s tough to find the right one, especially if you are a beginner to using this type of technology. However, you can choose the right one by checking your trading style, technological needs, budget, trading strategy and also the market access requirements.

With some scanners, you will simply point then click to execute any orders. Before starting a scan, you will click a few buttons. However, with other types, you need the best programming skills and statistical knowledge. If you don’t have a lot of computing power, you can choose a stock scanner than runs from the browser.

If you are looking for something that’s a little tense, you can use the desktop-based scanner but you need a powerful computer for the job. Of course, you need to consider the cost with all these options. Note that, depending on the type of scanner you choose, the cost might vary. For instance, some are used on a subscription basis while others require you to pay a flat monthly fee.

You can look at all the options available to choose the right one. However, you need to choose a scanner that’s a perfect fit for your trading style. You need a platform that serves all your trading needs. Therefore, take the time to do your research and find the best one for you.

Are There Different Types Of Stock Scanners?

Here are some of the various types of stock scanners available in the market.

- Fundamental Stock Scanners – These scanners use fundamental criteria such as ratios or metrics regarding the company’s commercial activities and much more. The scanners will also analyze the return on equity, the earnings per share and also the profit margins.

- Technical Stock Scanners – Here, the scanners will search for the price action, technical indicators, chart patterns and also the trading volume criteria. They perform the technical analysis of data.

- Post-Market Stock Scanners – Here, the scanners will check the actions of any stocks outside of the normal trading hours. When the market is closed, there is a lot of data available for analysis. It includes top gainers, losers and any stocks with a noticeable spike in their volume.

- Intraday Stock Scanners – Here, the scanners focus on the real-time action of the stocks when the market is still open. It requires a robust scanning program because there is too much data in use.

In conclusion, now that you understand stock scanners, what they are and the different types, you can choose the right one for your needs to guarantee the best trading in the market and overall results.

Ask any veteran trader, and they’ll let you know that stock scanners have changed everything. Things that used to take traders three to four hours can now be done in a matter of minutes with a few clicks of a button.

Ask any veteran trader, and they’ll let you know that stock scanners have changed everything. Things that used to take traders three to four hours can now be done in a matter of minutes with a few clicks of a button.